How Can I Avoid Paying Capital Gains Tax In California . Investors can realize losses to offset and cancel their gains for a particular year. If you don’t qualify for the full capital gains tax exemption, you may qualify for a. the california capital gains tax is levied at the same rate as regular income. Your gain from the sale was less than $250,000. you do not have to report the sale of your home if all of the following apply: The tax rate will depend on. This post will highlight seven different. This page walks californians through what they need to know. how can i avoid paying capital gains tax on real estate sales in california? homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. california taxes you on the profit of your residential sale as if it were ordinary income you earned. there are actually quite a few ways to legally avoid paying.

from www.dhtrustlaw.com

the california capital gains tax is levied at the same rate as regular income. This post will highlight seven different. how can i avoid paying capital gains tax on real estate sales in california? If you don’t qualify for the full capital gains tax exemption, you may qualify for a. Your gain from the sale was less than $250,000. This page walks californians through what they need to know. The tax rate will depend on. california taxes you on the profit of your residential sale as if it were ordinary income you earned. Investors can realize losses to offset and cancel their gains for a particular year. you do not have to report the sale of your home if all of the following apply:

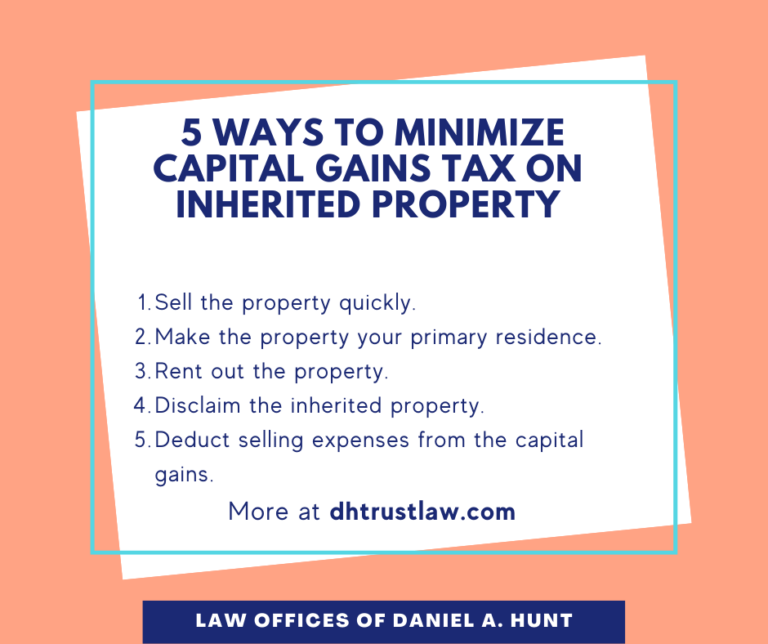

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt

How Can I Avoid Paying Capital Gains Tax In California you do not have to report the sale of your home if all of the following apply: If you don’t qualify for the full capital gains tax exemption, you may qualify for a. you do not have to report the sale of your home if all of the following apply: Your gain from the sale was less than $250,000. how can i avoid paying capital gains tax on real estate sales in california? Investors can realize losses to offset and cancel their gains for a particular year. This post will highlight seven different. the california capital gains tax is levied at the same rate as regular income. This page walks californians through what they need to know. homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. The tax rate will depend on. there are actually quite a few ways to legally avoid paying. california taxes you on the profit of your residential sale as if it were ordinary income you earned.

From taxwalls.blogspot.com

Capital Gains Tax On Sale Of Primary Residence In California Tax Walls How Can I Avoid Paying Capital Gains Tax In California the california capital gains tax is levied at the same rate as regular income. This post will highlight seven different. how can i avoid paying capital gains tax on real estate sales in california? If you don’t qualify for the full capital gains tax exemption, you may qualify for a. The tax rate will depend on. Investors can. How Can I Avoid Paying Capital Gains Tax In California.

From www.youtube.com

How to Avoid Capital Gains Tax in 2012, 2013 YouTube How Can I Avoid Paying Capital Gains Tax In California Your gain from the sale was less than $250,000. This page walks californians through what they need to know. The tax rate will depend on. This post will highlight seven different. If you don’t qualify for the full capital gains tax exemption, you may qualify for a. Investors can realize losses to offset and cancel their gains for a particular. How Can I Avoid Paying Capital Gains Tax In California.

From theadvisermagazine.com

How to Avoid Capital Gains Tax on Real Estate How Can I Avoid Paying Capital Gains Tax In California If you don’t qualify for the full capital gains tax exemption, you may qualify for a. california taxes you on the profit of your residential sale as if it were ordinary income you earned. homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. . How Can I Avoid Paying Capital Gains Tax In California.

From www.dhtrustlaw.com

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt How Can I Avoid Paying Capital Gains Tax In California If you don’t qualify for the full capital gains tax exemption, you may qualify for a. california taxes you on the profit of your residential sale as if it were ordinary income you earned. there are actually quite a few ways to legally avoid paying. Your gain from the sale was less than $250,000. how can i. How Can I Avoid Paying Capital Gains Tax In California.

From taxlawdictionary.com

Avoid Capital Gains Tax ⋆ Tax Law Terminology & Glossary 2019 ⋆ How Can I Avoid Paying Capital Gains Tax In California homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. how can i avoid paying capital gains tax on real estate sales in california? The tax rate will depend on. you do not have to report the sale of your home if all of. How Can I Avoid Paying Capital Gains Tax In California.

From www.carboncollective.co

LongTerm Capital Gain (LTCG) What Is It & How Does It Affect You? How Can I Avoid Paying Capital Gains Tax In California there are actually quite a few ways to legally avoid paying. Investors can realize losses to offset and cancel their gains for a particular year. This page walks californians through what they need to know. california taxes you on the profit of your residential sale as if it were ordinary income you earned. Your gain from the sale. How Can I Avoid Paying Capital Gains Tax In California.

From www.thepinnaclelist.com

Avoid Capital Gains Taxes With A 1031 Exchange The Pinnacle List How Can I Avoid Paying Capital Gains Tax In California how can i avoid paying capital gains tax on real estate sales in california? If you don’t qualify for the full capital gains tax exemption, you may qualify for a. homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. This page walks californians through. How Can I Avoid Paying Capital Gains Tax In California.

From www.searche.co.za

How to Avoid Capital Gains Tax On An Inherited Property How Can I Avoid Paying Capital Gains Tax In California This post will highlight seven different. Your gain from the sale was less than $250,000. This page walks californians through what they need to know. how can i avoid paying capital gains tax on real estate sales in california? there are actually quite a few ways to legally avoid paying. The tax rate will depend on. Investors can. How Can I Avoid Paying Capital Gains Tax In California.

From inflationprotection.org

capital gains tax explained Inflation Protection How Can I Avoid Paying Capital Gains Tax In California homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. This page walks californians through what they need to know. there are actually quite a few ways to legally avoid paying. This post will highlight seven different. how can i avoid paying capital gains. How Can I Avoid Paying Capital Gains Tax In California.

From www.movoto.com

California Capital Gains Tax Is it Possible to Avoid When Selling Your Home? How Can I Avoid Paying Capital Gains Tax In California homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. Your gain from the sale was less than $250,000. This page walks californians through what they need to know. there are actually quite a few ways to legally avoid paying. the california capital gains. How Can I Avoid Paying Capital Gains Tax In California.

From donatestock.com

How to Avoid Capital Gains Tax on Stocks DonateStock How Can I Avoid Paying Capital Gains Tax In California how can i avoid paying capital gains tax on real estate sales in california? there are actually quite a few ways to legally avoid paying. This post will highlight seven different. you do not have to report the sale of your home if all of the following apply: Your gain from the sale was less than $250,000.. How Can I Avoid Paying Capital Gains Tax In California.

From codyrudolph.com

How to Avoid Paying Capital Gains Tax on Inherited Property Cody Rudolph How Can I Avoid Paying Capital Gains Tax In California how can i avoid paying capital gains tax on real estate sales in california? This page walks californians through what they need to know. The tax rate will depend on. homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. you do not have. How Can I Avoid Paying Capital Gains Tax In California.

From fabalabse.com

Can seniors avoid capital gains tax? Fabalabse How Can I Avoid Paying Capital Gains Tax In California Investors can realize losses to offset and cancel their gains for a particular year. If you don’t qualify for the full capital gains tax exemption, you may qualify for a. This page walks californians through what they need to know. california taxes you on the profit of your residential sale as if it were ordinary income you earned. . How Can I Avoid Paying Capital Gains Tax In California.

From www.bbnc.in

How to Avoid Paying Capital Gains Tax When You Sell Your Stock? BBNC How Can I Avoid Paying Capital Gains Tax In California the california capital gains tax is levied at the same rate as regular income. This page walks californians through what they need to know. If you don’t qualify for the full capital gains tax exemption, you may qualify for a. homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their. How Can I Avoid Paying Capital Gains Tax In California.

From netwhile.spmsoalan.com

How To Avoid Capital Gains Tax On Property Netwhile Spmsoalan How Can I Avoid Paying Capital Gains Tax In California This post will highlight seven different. how can i avoid paying capital gains tax on real estate sales in california? If you don’t qualify for the full capital gains tax exemption, you may qualify for a. Investors can realize losses to offset and cancel their gains for a particular year. The tax rate will depend on. This page walks. How Can I Avoid Paying Capital Gains Tax In California.

From www.hallacctco.com

How To Avoid Paying Capital Gains Tax on… Hall Accounting Company How Can I Avoid Paying Capital Gains Tax In California The tax rate will depend on. there are actually quite a few ways to legally avoid paying. This page walks californians through what they need to know. If you don’t qualify for the full capital gains tax exemption, you may qualify for a. Investors can realize losses to offset and cancel their gains for a particular year. how. How Can I Avoid Paying Capital Gains Tax In California.

From www.youtube.com

What are Capital Gains Taxes? How Can I Avoid Them? What You Need to Know! YouTube How Can I Avoid Paying Capital Gains Tax In California how can i avoid paying capital gains tax on real estate sales in california? california taxes you on the profit of your residential sale as if it were ordinary income you earned. This post will highlight seven different. This page walks californians through what they need to know. Your gain from the sale was less than $250,000. If. How Can I Avoid Paying Capital Gains Tax In California.

From exprealty.com

Avoiding Capital Gains Tax On Real Estate in 2022 eXp Realty® How Can I Avoid Paying Capital Gains Tax In California This post will highlight seven different. how can i avoid paying capital gains tax on real estate sales in california? homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, under certain conditions. Investors can realize losses to offset and cancel their gains for a particular year. . How Can I Avoid Paying Capital Gains Tax In California.